Save over 20% of the Cost of your Annual Loan Portfolio Management Expenses

“That's over 30 days per year in Savings to Manage your Banks Primary Asset. ”

The Loan Navigator Features |

|

|

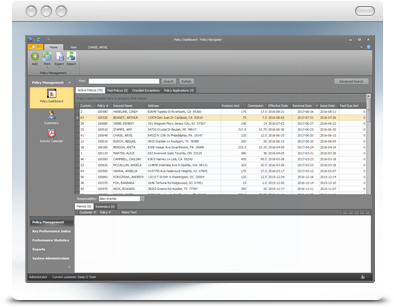

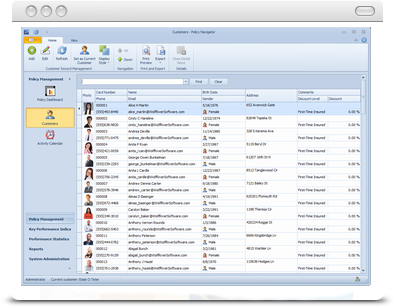

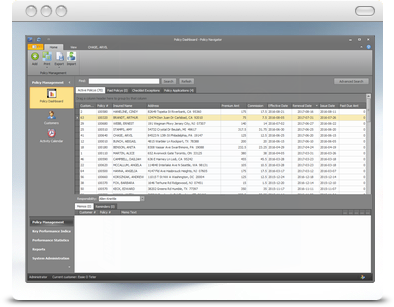

Complete Loan Life Cycle Management

View Newly Submitted Customer Loan Applications From Your Institutions own Customizable Web Site Add Loan Decisioning Data to Submitted Applications along with Comments, Diary Reminders and Document Attachments On Approval and Funding Upload The Loan Application to document systems like such as LaserPro from Harland Financial Services Merge Application Memos, Comments, Reminders and Attachments to New Loan After Next Days Import Paid Loan History Exists for Review After Loan Pays Off and is Removed From Active Loans completing the life cycle Historical Loan Details Provide Valuable Analytical Data For Performance and Trend Analysis |

|

Loan Documentation Exception Management

Proper Documentation and Reporting helps keep your Loan Portfolio within Regulatory Compliance Identify Volumes and Responsibility of Outstanding Loan Documentation Exceptions at a Glance |

|

Loan Comment Documentation Management

Loan Comment Review provides clear history of interactions in loan processing to provide valuable protection against disputes Measure your loan officers performance and effectiveness with our comment review check-off system |

|

Collabrorative Team Production Platform

Produce Custom Reports and Documents in a shared environment to promote a highly team oriented work flow Establish and Maintain a more effective communication work flow between you and your staff |

|

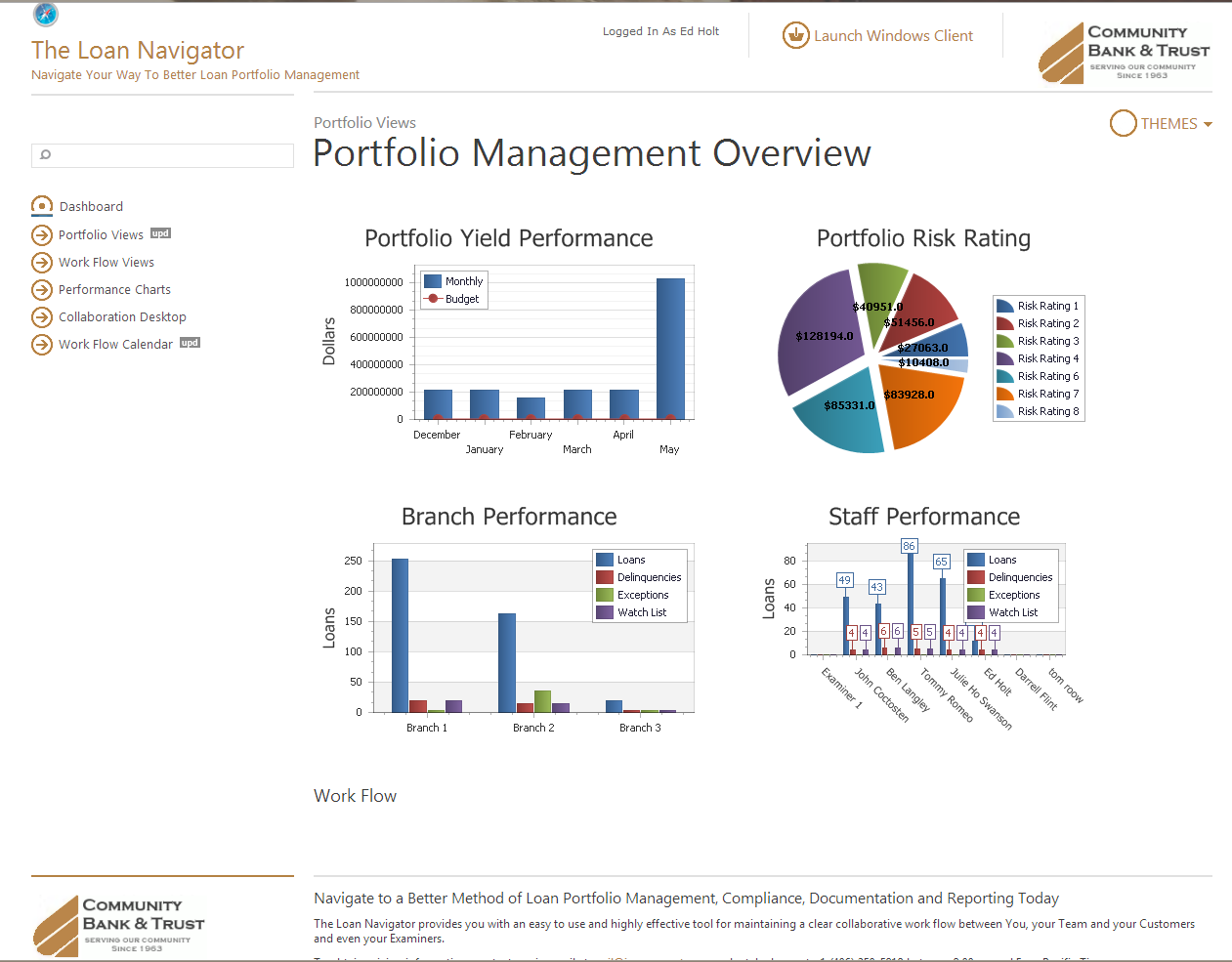

Mobile Loan Portfolio Management Dashboard

Intuitive Graphical Dashboard Provides Clear Consise Visual of Your Institutions Revenue, Risk, Branch, Staff Performance Status at a Glance On-Line Board of Directors Reports allows for convienient access to critical portfolio information Loan Query and Report Generation and Data Export gives your Portfolio Information Complete Portability to Integrate into your Reporting Needs Loan Processing Work Flow Reports allow you to focus in on inefficient processes or impediments to prevent Document Exception Volume |

|

Triple Layer Network Security

With The Loan Navigator's exclusive “3 Lock Box Security” your Data is Safe and Protected Web, Application and Data Server Tiers Each Require Unique Authentication For Every User Request Secured Socket Layer (SSL) along with Custom Encryption of Sensitive Data Provides the Highest Level of Protection of Your Valuable Information |

|

Work Flow Activity Calendar to Visually Manage Work Flow

Visualize New Applications, Un-Reviewed Comments and Document Exceptions in our Work Flow Activity Calendar Integrate Diary Reminders into Microsoft Outlook |

|

Accumulated Historical Loan Analytical Data

From the First Day that you start using The Loan Navigator you will be collecting highly valuable historical data Identify Trends and Performance Information about your institution, customers, loan work flow as well as your staff operational effectiveness. |

|

Real Time Reporting

Generate Customizable Reports From your Loan Portfolio Export Active Loan Portfolio Information to PDF, Excel, Word and more Consume and View Customer Accounting Information Data Pulls Using our Web Portal API Services Integration Integrates to Accounting Software such as QuickBooks©, Farm Works© and SmartContractor© to Publish Customer Income and Balance Sheet Reports Directly to You |

|

Web-Based Solution that is easily deployed with zero desktop installs

The Loan Navigator is offered as a Software as a Service offered as a subscription service You can be up and running and leveraging the advantages of The Loan Navigator in a matter days You can be up and running and leveraging the advantages of The Loan Navigator in a matter days Click Here to start gaining savings and performance right now. |